Self employment tax: What you need to know

Filing a tax return is probably the biggest pain in the arse for anyone who’s self-employed. From going through your invoices and receipts to working out how much you owe, there’s a lot. Essentially, saying it’s complicated is the understatement of the century. Luckily, you can find out all you need to know about self employment tax below.

How to do self employed taxes

Probably the second question on people’s minds when they take the leap and start working for themselves (behind WHAT DID I JUST GET MYSELF INTO) is ‘How to do self employed taxes’. Well, we have the answer right here.

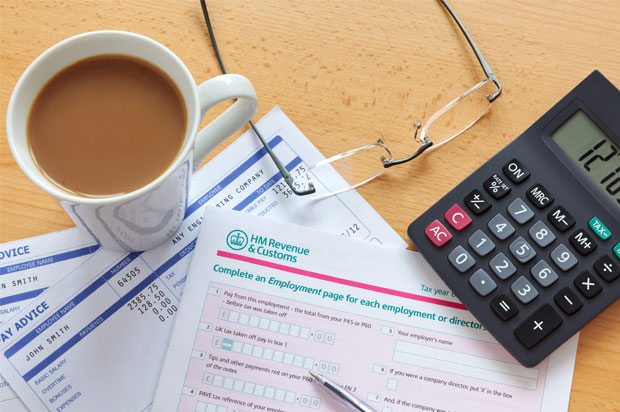

Every year (yes, it’s a recurring nightmare) you need to fill out a Self Assessment form and return it to HM Revenue & Customs (HMRC). Some key info to remember is that tax years run from April to April, and if you’re completing the form online, the deadline is 31st January for the previous year. Alternatively, if you want to submit your tax return on paper, you need to get it in by 31st October.

When do you have to pay self employment tax?

Whether you’re submitting your return online or doing paper tax returns, you’ll need to return and pay your tax bill by 31st January. But that doesn’t mean you should leave it ‘til the 30th to start. Remember, the sooner you tackle your return, the sooner you’ll be able to be free of the whole thing. You may be asked to make a payment on account (a partial payment) in July towards your next year’s bill. Just in case, we recommend that you put away enough money to cover this so it doesn’t come as a nasty surprise.

While you’re doing your taxes (so basically for the majority of your life) you’ll need to hang on to ALL paperwork. This includes everything from the seemingly insignificant stuff like receipts to the really important shit like invoices and bank statements. The HMRC may actually ask to see these. So filing is preferable to stuffing them down the sofa.

If you’re feeling super overwhelmed about tax calculations, consider hiring a tax accountant. Not only can they help to get your head around the jargon, but they could also help you pay less tax. Thing is, the savings you make from using them often pay for themselves, and accountants’ fees are also tax deductible (basically paying their fees comes out of your self employment income and reduces the tax you’ll need to pay).

How to pay self employment taxes

There are loads of options. You can either pay online, by bank transfer, direct debit or by cheque. Just make sure you leave enough time before the deadline for the payment to clear.

Do I have to pay tax if I’m self employed?

If you’re earning money, then yes. The minute you become self-employed you’ll need to inform your local tax office or register for self assessment. Straight away. Like, forget about calling your mum to share the good news, call your tax office instead.

Once you’ve registered, they’ll normally ask you to submit a tax return every year (where you’ll be expected to detail your business income and expenditure). Effectively, this means that you won’t be asked to pay tax for 12 months. But it’ll be looming in the background from day one.

How much is self employment tax?

You’ll pay the same rate of income tax as someone who’s employed – which is usually 20%. Plus, you’ll have to make National Insurance contributions. Unlike the rest of your taxes, these’ll be classed differently to an employed person. You should receive a quarterly bill for NI, or you can arrange to pay by Direct Debit. If you’re earning below the small earnings exception limit, you may want to apply for an Exemption Certificate. Just be warned that this could affect your entitlement to some benefits.

You’ll also have pay some more NI as a percentage of what you earn (there are different pay classes). Plus, there might be some capital gains tax added on top of that. These are usually worked out as part of your tax return.

You can find out about income tax here and National Insurance contributions here.

Can I bring down my tax bill if I’m self employed?

The good news is that you’re entitled to deduct business expenses from your income – basically the stuff that relates to your business. This doesn’t mean that you get any money back – just that you don’t have to pay tax on those expenses. For example, a self-employed film critic might claim for cinema tickets and movie review magazines, plus the cost of setting up a website.

To claim, you need the receipts. So start collecting/itemising everything you spend. What you can claim largely depends on your line of work (although new undies would definitely be pushing it). And some items may only be eligible as a percentage or set allowance. Once again, this is where a tax advisor can come in handy.

What’s VAT for self employed people? And do I have to pay that too?

The bad news: VAT is wildly complicated and hard to understand.

The good news: If you’re a small business then you probably don’t have to worry about it. Unless you’re earning over £85,000.

VAT is a type of government taxation that applies to ‘business transactions’, on everything from buying toothpaste to getting your haircut. If you earn more than the current VAT threshold – currently £85,000 – before expenses in any 12-month period, then you have to think about it. At that point, you’re legally required to become VAT registered and charge VAT on anything you earn.

Do self employed people have to pay business rates?

Business rates can apply to anyone who uses a property for business purposes. A lot will depend on the kind of work you do. Not to mention, whether you have business contacts or clients visiting, can affect your insurance, too. For example, jotting notes at the kitchen table isn’t likely to cost you a penny. On the other hand, if you’re renting premises, or your home has been transformed into a tie-dye factory, then be prepared to pay.

For more info, take a look at the rest of our articles on self employment here. You can also learn more on the government’s self assessment tax return website here.

Next Steps

- Chat about this subject on our Discussion Boards.

By Nishika Melwani

Updated on 13-Jun-2022

No featured article